100% mobile onboarding

From user registration and identity verification, to mandate confirmation and submitting service applications, everything can be done on mobile anytime, anywhere.

Real-time updates

Easy, real-time updates of customer due diligence information is just a few taps away, enabling effective compliance with ongoing customer due diligence requirements.

Banking regulatory standards

Customer due diligence information verified in accordance with the prevailing banking regulatory standards in Hong Kong.

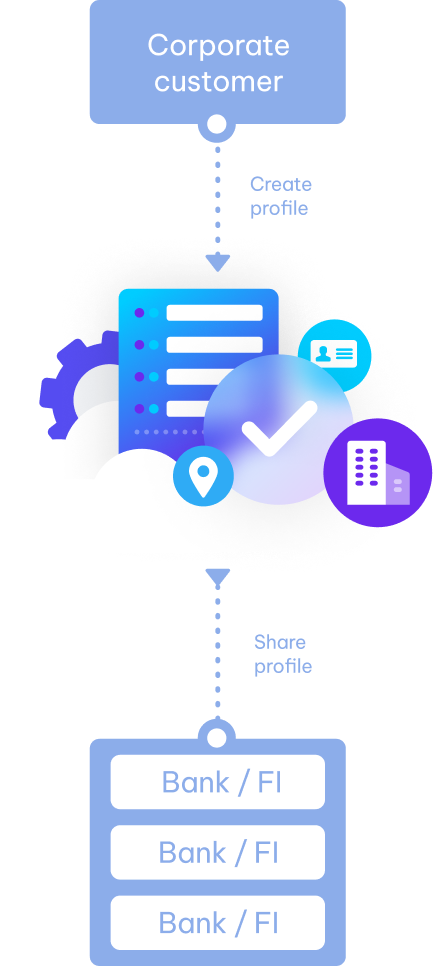

How Does It Works?

A corporate customer, through its participation in RD ezLink, can create a verified business profile in digital format, and if it so wishes, the profile can be shared with banks or other financial institutions for account opening and ongoing CDD purposes, thereby avoiding the need for repeated manual efforts in form-filling by the customer and processing by banks.

RD ezLink would greatly improve customer experience and reduce operational costs in acquiring and maintaining corporate customers, especially SMEs.

Moreover, RD ezLink aims to make use of payments made by the customer and other data originated from e-wallets or other relevant sources to provide data analytics that would facilitate the access to credit facilities of banks or other financial institutions.

The core design of RD ezLink is unique in that the creation, storage and sharing of any company information or profile are all initiated and consented by the corporate customer concerned.

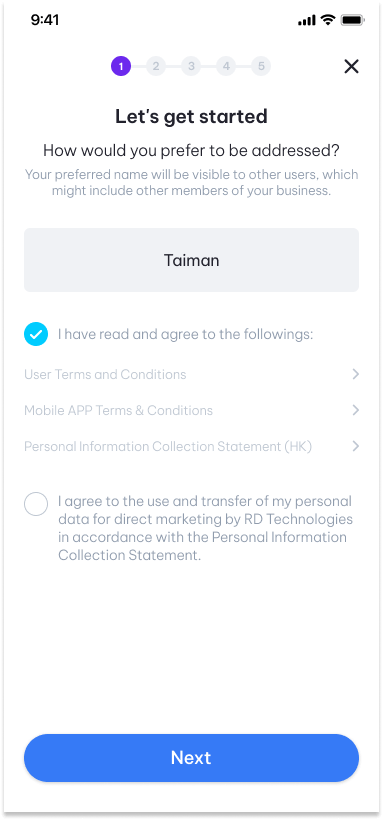

Enter your preferred name and confirm the terms and conditions

Create your PIN code and confirm

Enter and verify your email address and mobile number

Select your identity document type (please use the ID from your business registration)

Take a photo on your ID and a selfie

Complete the verification and please wait for the results

RD ezLink Corporate ID

By using the RD ezLink Corporate ID Services, you have read and agree to be bound by its Terms of Use.